The forecast for the solar industry is bright and sunny with California the epicenter of both job creation and PV installations.

A five-year extension of the federal solar investment tax credit is expected to more than double the national solar workforce to 420,000 and add 20 gigawatts each year, boosting annual capacity by more than was added to the grid cumulatively through 2014.

The projections are from the Solar Energy Industry Association based on data from GTM Research. The market forecast followed the decision by Congress last December to extend the Solar Investment Tax Credit (ITC) for residential and commercial installations.

California already leads US in solar jobs, installations

The extension is great news for California’s robust residential and commercial solar industry. The state in late 2015 led the U.S. in number of jobs, according to National Solar Jobs Census 2015, from The Solar Foundation. The full report, as well as statistics from earlier years, is available at tsfcensus.org.

“For SunGreen Systems as well as the rest of the solar industry, the ITC extension means growth as well as stability over the next decade,” said John Hoffman, Managing Partner of SunGreen. “We won’t need to rush and clients and potential clients can better evaluate their options without a deadline facing them this year.”

SunGreen, which specializes in designing as well as installing commercial solar systems, enabled hundreds of customers to benefit from the 30% Federal tax Credit (ITC).

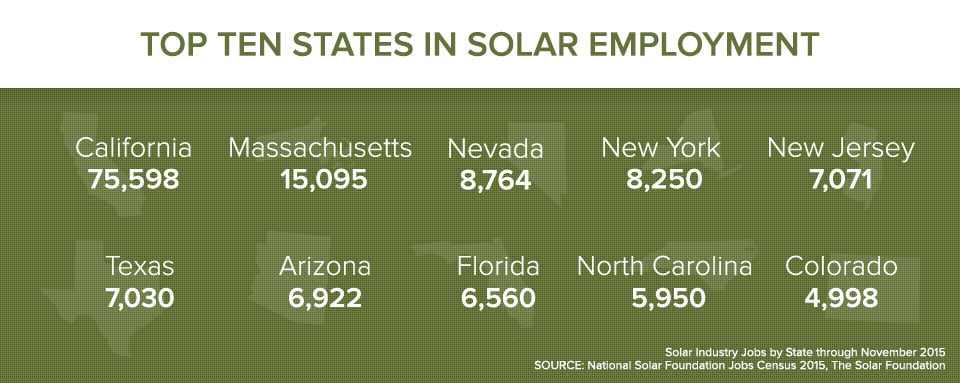

As of November 2015, California’s solar sector employed 75,598 solar workers, a jump of 38.2 percent in employment over the 2014, the foundation found. Industry experts expect the state’s solar job count to top 90,000 this year. Additionally, California led the nation in number of commercial solar installations through 2015, with 548 projects averaging, according to the 2015 Business Solar, from Solar Energy Industries Association.

That’s 70 percent more than the New Jersey, which ranked second in total commercial solar installations. And five times more jobs than Massachusetts, with 15,095.

ITC extension to add 51% more non-residential solar installs

Both residential and business customers have received a 30 percent tax credit on their solar investments since 2009, and the ITC was scheduled to end in December 2016 for residential solar and drop to 10 percent for commercial solar projects.

The extension keeps the 30 percent tax credit in place for residential and commercial projects through the end of 2019, then drops to 26 percent in 2020 and 22 percent in 2021. After that, it settles at 10 percent for commercial projects and disappears for residential projects.

GTM Research also estimated the tax credit extension will lead to 35 percent more residential installations and 51 percent more non-residential installations between 2016 and 2020.

For the solar industry, the extension will add up to $40 billion in incremental investment and more than double the sector’s job total, according to SEIA.

What will it mean for you?